NICEAngels

Network

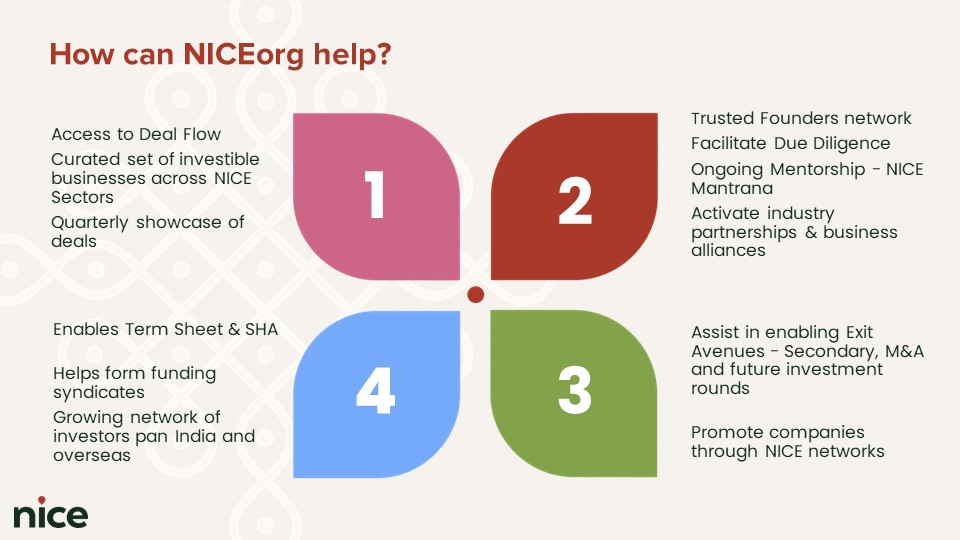

#NICE Angels Network is a network of NICE Angel investors interested in the early and growth stage investment program for cultural enterprises. Cultural enterprises are curated based on, among other criteria, NICE sector fit, growth markets, the founding team and business model. This curated set of start-ups pitch to NICE Angel investors who are ready to invest anywhere from INR 5 lakhs to 50 lakhs to support the creation of successful cultural enterprises as envisaged by NICEorg.

NICE Angels are available to, on a best effort basis, provide mentoring, guidance and networking assistance to the companies in addition to their funds.

NICE Angels Network members will be involved in providing inputs on #NICEAngels strategy, operations and deal sourcing. They will however invest through the #NICEAngels Network.

To know more about the kind of investors that NICEorg seeks to have in its network, visit NICE Investors.

- Opportunity to meet other NICE Angels, partners, thought leaders, govt officials and service providers across the country

- Form investment syndicates

- Opportunity to participate in NICE Aarohana, NICE Aarohana business plan competitions, NICE Mantrana & Samvaad sessions

- Meet exciting entrepreneurs, industry and business leaders

- Access at least 25 investment opportunities each year

- Have basic DD done on cultural enterprises of interest

- Strong entrepreneurial and operational background of investors

- Willingness to invest money and time

- Ability to leverage a large and growing network

- Simple term sheet

- Quick feedback on the investment decision

- Patient capital

#NICEAngels are likely to invest in enterprises that meet the following criteria:

- Strong fit with NICE Sectors

- A management team with vision, passion and drive

- Complementary capabilities, experience and expertise

- Brand, market and numbers savvy

- Scalable business model

- Differentiated with respect to the competition

#NICEAngels is founded on strong values and a fitting code of conduct – funding cultural enterprises is central to NICEorg’s vision to catalyze Brand India.

The primary deal flow for the network comes through the ecosystem and valued partners.

#NICE Angels Network members may also individually assess funding proposals that they might come across. In addition, they might create investment opportunities with entrepreneurs and other NICE Angels. All such recommended opportunities will then be presented at #NICE Angels’ quarterly Investment Meets as “sponsored” deals, i.e.a member who feels the deal is worthwhile enough to be presented at this Meet and works with the entrepreneur to ensure the company is adequately prepared.

However, all deals will be vetted through an elevator pitch session with NICEorg mentors Basic DD conducted on the companies – GST, Audited financial statements where applicable, IP & voluntary disclosure of legal risks

- All members present will, after the entrepreneur presentations, discuss and debate each investment on the pitch day or at a convenient time, or ask for any additional information required, etc.

- Each #NICEAngels Network member will make his or her individual decision on investing in any given opportunity.

- NICE Angels may decide to partner with each other or with other investors known to them to form an investment group. These other investors will become part of the #NICEAngels Network

- It is understood that all the money asked for by the company may not be raised through the NICE Angels Network. Those NICE Angels members who have committed or are interested in a company would make best efforts to help the company raise any balance funds. NICEorg will facilitate this process.

- As a broad outline, it is expected that members will invest in the region of Rs 5-50 lakhs per annum.

Any arrangements for any financial compensation, in cash or kind, would need to be agreed to by the NICE Angel investor and entrepreneur /promoter/company alone.

It must be understood that the role of NICEorg is only to facilitate funding.